It’s a known fact that the planet earth receives an average of 174 Petawatts (PW) of incoming solar energy from the sun, a star. The total amount of energy received from sun in one hour time frame is enough to satisfy the global power needs for up to one year. The solar power received on earth for 6 months is equal to the total power that can possibly be generated from all types of non-renewable sources including uranium/nuclear power as well as oil, natural gas, and coal. Around 70% of solar energy that the earth gets is absorbed by land, cloud, water bodies and rest is reflected back into space. Since time immemorial solar energy has been used by humans to meet their heating and power requirement.

The impending scarcity and rising cost of electricity generation worldwide; means that we need to bolster the use of renewable sources of energy. Non-polluting sources of energy like wind, bio-gas, water, biomass, geothermal, and solar can be the answer to the problem. Solar power is the perennially available and free of cost energy source that if used properly for generating electricity can help not just offset the shortfall in grid-provided energy but also help cut the pollution levels. One of the biggest advantage of solar power s that it can be used for providing either backup power or to operate as standalone source of electricity independent of the utility grid.

Sun’s energy is free but setting up a MW scale solar plant to tap that endless source of power can be very capital-intensive. As such financing options to set up a solar power plant is one of the biggest hurdles faced by not just by individual users of solar power plant but solar EPC contractors as well who want to develop a profitable venture.

Financing a Solar Project

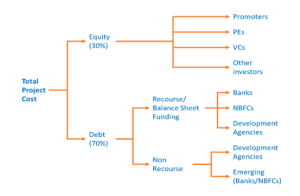

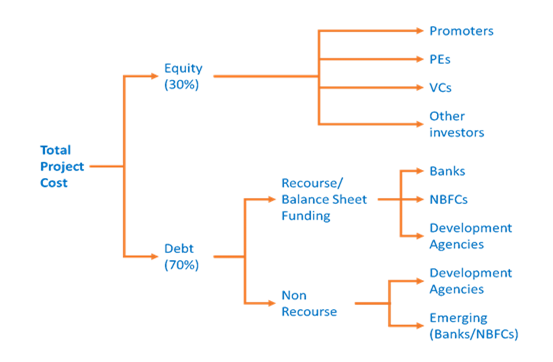

It is critical to select a proper financing option for setting up a solar power project. The usual cost of setting up a solar power plant is around INR 6 Crores/MW. On a general basis 30% of the cost is met by equity funding, and the rest through debt financing. Equity is another word for funding from internal resources or from other investors. Debt financing is available only in lieu of a collateral security against the loan. However debt financing without recourse is an option enjoyed only by big players who have established large scale solar power plants and enjoy a consistent track record for a number of years. Having said that EPC contractors in India who go in for setting up MW solar power plants, usually opt for debt-equity mix. The chart below will give the readers an understanding of the financing options for setting up a MW scale solar power plant in India.

Criteria to Finance Solar Project

There are certain criterions that the investor should look upon before investing in a solar power project. These are:-

- Positive cash flow from operations in the company.

- Company debt is less than 40% of its net worth

- DSCR (Debt Service Coverage Ratio) of the company is greater than 1.5.

Steps to Finance and Fund Solar Power Project

In order to get loans/debt financing, the contractor can look for an investor from the domestic or international market.

Domestic Financing (Mainly From Banks):

As of 2015, Indian banks are the biggest lending partners for solar power projects in India with interest rates hovering in the range 11-13%, NBFCs lend at slightly higher rates. IREDA (the Indian government’s renewable energy lending arm) lends at lower rates (10.2-11.4%). Collaterals required for eligibility for finance could vary from 20% for entities such as IREDA to full 100% for banks. Domestic loans are usually over a period of 7-10 years, although Indian banks have now gotten comfortable lending money for a period 15 years wing to the factors such as gestation period, approvals, certifications that are the prime cause of delays in fruition of a solar power project.

International Financing:

As of 2015, the interest rate for loans in order to finance a solar power project from international sources is usually between 8-10%, after due diligence and factoring in all related costs, including hedging cost for exchange risks. One needs to know that getting an international financer for a solar project is a time consuming affair, and also which international financers are ready to provide loans.

It could be anywhere upto 9 months to 1 year and this could affect the time taken to kick start the project. Eventhough interest rates are lower for foreign finances, the cost of hedging against currency fluctuations must also be factored in. Foreign debt financing is available for a period of 16-18 years, however a few things must be taken into before sanction of loan such as:-

Is it possible to procure low interest of financing for MW scale solar power project? If yes, what are the terms and conditions?

One scenario where it is possible to get finance for solar power projects from foreign lenders is if the components used to set up the solar power project are also imported from the lending country. In that case DCR (Domestic Content Requirement) projects that stipulate sourcing from domestic market are typically not be eligible for international finances. Financing on the whole only covers a part of the project cost, typically solar panels. As such funding for the rest of the project still needs to be done. Moreover, time to process the loan application is in the range of 9-12 months, which can easily impact financial solar project start/closure time.

Due diligence cost can push up the cost of a solar power project (as much as 6% to loan interest rate), making it viable only for solar plants with larger capacity (greater than 10 MW) to be profitable. Moreover, repayment options for international finances are completely dependent on foreign exchange rate fluctuation. Additional terms imposed, such as use of shipping lines from the lending country can also push up the cost.

NBFC Financing

Some NBFCs like IREDA (Indian Renewable Energy Development Agency) provide low-interest loans to finance solar power projects in India. For example, grid-connected solar PV projects can avail interest rates from IREDA at the rate of 10.2 -11.4% depending on the grading (Grade I, Grade II, Grade III or Grade IV) given to the solar power project by the authorities.

One of the most attractive aspects of financing via IREDA is that the collateral to be provided for securing loan is only around 10-33% of total loan applied for. As such; making repayment amount and payment options considerably low in comparison to a bank. It should also be noted that IREDA generally provides financing for any solar power project that has a minimum debt requirement of INR 50 Lakhs based on their techno-commercial viability.

What are the documents required to apply for loans from NBFCs?

The following documents are to be produced by the investor while applying for the loan:-

- PPA

- Feasibility study

- PC contract

- Quality and safety standards followed

- O&M contract

- Evacuation

- Contracts for supply of components

- List of permissions and compliance acquired/to be acquired

How Due Diligence Affects Costs

The time and money spent on the below even though essential can affect the overall cost as well as time taken to execute a project. These are:-

- Promoter Appraisal

Due diligence of aspects related to promoter background, validating financial statements, validating promoters net worth, as well as promoters ability to contribute equity on the on a later date.

- Technical Appraisal

Solar radiation verification, as well as technological assessment, and Detailed Project Report assessment.

- Financial Appraisal

Due diligence of financial/funding details related to solar project cost, means of financing structure (debt-equity ratio) and foreign exchange risk.

- Environmental Appraisal

Due diligence of all types of related environmental risks must be taken by conducting environmental impact assessment study.

- Insurance Package

Ensure that the project developer has obtained insurance cover for the project risks.

- Industry Specific Appraisal

Due diligence of market trends and costs, market attractiveness, creditworthiness of risk taker, risk guarantees, regulatory and policy scenarios.

- Loan Approval

Approval of loans taken from the financial institution based on the analysis of credibility of the project developers.

- Legal Appraisal

Due diligence envelop includes various contractual agreements like PPA, Purchase Orders (PO), Legal land agreements and contracts and approvals.

International Financers in India

International Finance Corporation (IFC), the financing arm of the World Bank is engaged in financing of solar power projects in India. EXIM Bank is also a good option for getting finances of solar power projects. The Asian Development Bank has also emerged as a prominent lender to promote solar power projects in India. European Investment Bank (EIB) is also interested in financing solar parks in India. Apart from these institutions, many green energy funds are providing equity funding at a cheaper rate for solar power projects.

Risk Factors in Funding Solar Projects

- Regulatory Risk – Fixing of the tariff and assurance on the power sale agreement.

- Technology Risk – Technology yet to be proven on the ground.

- Implementation Risk – Uncertainties in the implementation of the project as per schedule.

- Infrastructure Risk – Inadequate evacuation facility and clearances on land and other statutory clearances.

- Repayment Risk – Non assurance of repayment from the utilities may result in repayment risk to the developers.

- Political Risk – Changes in fixing of unallocated power with respect to change in political system.

- Policy Risk – Assurance of long term policy with greater accuracy and uncertainties in development of the solar sector.

- Guarantee and Warranty Risk– Long term guarantee as well as warranties from the technology providers for the new technology.

- Financial Risk – In time financial closure by project developer, high cost of funding from a single source, raising equity.

After going through the above mentioned scenario we can safely say that even though due diligence is important for financing a solar power project or for that matter any project; it does however have an impact on the cost of project and time taken to execute a project. While financing from Indian financial institutions is the best option but opting for foreign financers is also an option but risks abound including hedging against fluctuating currency exchange rates. As such one must give a proper thought to every aspect of financing for a solar power project before deciding on whom to seek finance from and how much finance is viable without affecting the monetary situation of the company.

About Vivaan Solar

Vivaan Solar as a EPC contractor is a solar PhotoVoltaic system installer & integrator. We have installed 60 MW solar park in Madhya Pradesh, 5 MW in Punjab, 8 MW in Uttarakhand and an upcoming park in Karnataka. We are also MNRE accredited channel partner for Rooftop. We have done turnkey works for multiple companies across the country and has third party agreements with some of the leading industries/commercial institutions across the state. We are an MNRE accredited channel partner. For more info you can visit our website: www.vivaansolar.com or mail- info@vivaansolar.com.

Source: –

http://www.solarguidelines.in

http://www.solarmango.com/ask/2015/09/15/what-are-the-financing-options-available-for-mw-solar-plant-in-india

http://www.firstgreen.co/2014/03/financing-options-for-solar-power-project

http://www.iitj.ac.in/CSP/material/JNNSM-Final.pdf

Nice article..

“India has been a key member of the International Solar Alliance and played a crucial role in laying its foundations. With the push towards solar energy in India.” – We are India’s leading integrated solar energy solutions company providing innovative solar power solutions for residential and commercial needs. Our team of expert technicians and engineers are driven by the vision of clean energy and a green planet.

Visit for more : http://www.brihat.in/solutions/solar-power-solutions/

Thank you 🙂

dear

sir/madam

Thanks for the appreciation for writing the blog and do spread the word about our blog.

We do like to share useful information on solar power and renewable energy and technology and add our perspective and please share the info with your friends.

Keep watching this space for the latest blog updates and do watch our social media profile.

Dear

I want to install solar system at my home.how can i get loan

dear

sir

please visit your local bank for finance option as well as local solar authority as they will help you in getting needed subsidies if it applies in your region. Also you can visit a trusted local solar EPC contractor to know additional details

Hi,

Planning to install 1mw solar power plant. Please let me know the ways and means to get in touch with the investors.

Thanks

dear

we at Vivaan Solar are very much capable of meeting your requirement

contact us at info@vivaansolar.com for a further discussion

btw keep watching this space for the latest blog updates and do watch our social media profile.

9869428278

dear

sir/madam

Thanks for the appreciation for writing the blog and do spread the word about our blog.

We do like to share useful information on solar power and renewable energy and technology and add our perspective and please share the info with your friends.

Keep watching this space for the latest blog updates and do watch our social media profile.

please be specific with your requirement & share details

Are you in need of a Loan/Funding for a project? Have you been trying to obtain a Loan from any of the Banks or Loan Companies and got Ripped off and they have refused to grant you the Loan because of bad credit? we offer all types of non-recourse Loan and funding at a low Interest Rate of 3% both long term and short term.

The categories of Loan/financial funding offered include but not limited to: Business Loan, Personal Loan, Company Loan, Mortgage Loan, debt consolidation and financial funding for both turnkey and mega projects E.T.C. from a minimum of Euro/US$1Million to Euro/US$5Billion Max.

We also specialize in lease and sales of Bank Guarantee {BG}, Standby Letter of Credit {SBLC}, Medium Term Notes {MTN} and Confirmable Bank Draft {CBD}, this financial instrument is issue from AAA Rated bank such as HSBC Bank, UBS Zurich, Barclays Bank , Standard Chartered Bank E.T.C.

The financial instrument can be invested into High Yield Investment Trading Program {HYITP) or Private Placement Program (PPP). We are direct to a genuine and reliable Financial Organization, without broker chain or chauffer driven offer.

Kindly get in touch for further details and procedure.

Regards

Mr.Marco Kunkel

Email: marcokunkel2008@yahoo.com

Advertisement from BURTON LOAN FIRM a loan/financing company offering loans at an interest rate as low as 3% annually. Contact us below and get funded within 24 hours.

Email: BURTONPAULLOANFIRM@YAHOO.COM

Webpage: http://www.burtonpaulloanfirm.wix.com/loan

Facebook page: https://www.facebook.com/burtonloanfirm/

MIDWEST LOAN SERVICES is a Financial business established in Michigan, United States Founded: October 1991.

We are a licensed online lender serving the financial needs of online customers with a staff that pioneered online lending and has decades of combined lending experience. MIDWEST LOAN SERVICES continues to pioneer lending on the internet with reliable, secure and user-friendly lending philosophies.

We are a national alliance of leading mortgage lenders offering a broad range of loan products to suit a wide variety of customer needs, including new home purchase, refinance and home equity loans, Fix and Flip. We also provide you with Funding for your Debt Consolidation, Personal Expenses, Car Purchase, Business Expansion, etc.

Our Funding benefits include:

•Quick Approval @ a 3% Interest rate,

• 3 Months Grace Period,

• Flexible terms (30 year maximum),

• No pre-payment penalty

• Real and easy,

• Credit reports are not mandatory.

Do reply this mail to find out if you qualify for funding.

Email: midwestloanservices@gmail.com

Kind Regards.

dear

sir/madam

Thanks for the appreciation for writing the blog and do spread the word about our blog.

We do like to share useful information on solar power and renewable energy and technology and add our perspective and please share the info with your friends.

Keep watching this space for the latest blog updates and do watch our social media profile.

Superb article very informative.Thank you so much.I have a question about ppa which I read above.How this ppa happen? I mean At which stage of project owner gets PPA? before installing project or after finishing installment of project?How one can acquire PPA from authorities?is tarrif fixed or there is reverse bidding for tarrif? Also with whom they are going to bid? I mean if some one have land he wants to build solar project in his own land why he has to face reverse bidding against third party as if it is governments project tender? Whats current tarrif of power sale in mw level project..Just curious to know. Thank you.

dear

sir/madam

Thanks for the appreciation for writing the blog and do spread the word about our blog.

We do like to share useful information on solar power and renewable energy and technology and add our perspective and please share the info with your friends.

Keep watching this space for the latest blog updates and do watch our social media profile.

for more info get in touch with us on info@vivaansolar.com

Planning to install 12KW solar panels on my roof top. From finances could be arranged?

dear

sir/madam

Thanks for the appreciation for writing the blog and do spread the word about our blog.

We do like to share useful information on solar power and renewable energy and technology and add our perspective and please share the info with your friends.

Keep watching this space for the latest blog updates and do watch our social media profile. get in touch with us for more info on info@vivaansolar.com

Please call me

dear

sir/madam

Thanks for the appreciation for writing the blog and do spread the word about our blog.

We do like to share useful information on solar power and renewable energy and technology and add our perspective and please share the info with your friends.

Keep watching this space for the latest blog updates and do watch our social media profile. for more info get in touch with us on info@vivaansolar.com

As a fresher i want to start a solar power plant( commercial) of 1MW. Can i get a loan for this as a startup plan.?

dear

sir/madam

Thanks for the appreciation for writing the blog and do spread the word about our blog.

We do like to share useful information on solar power and renewable energy and technology and add our perspective and please share the info with your friends.

Keep watching this space for the latest blog updates and do watch our social media profile.